Published 2024-10-17 16-39

Summary

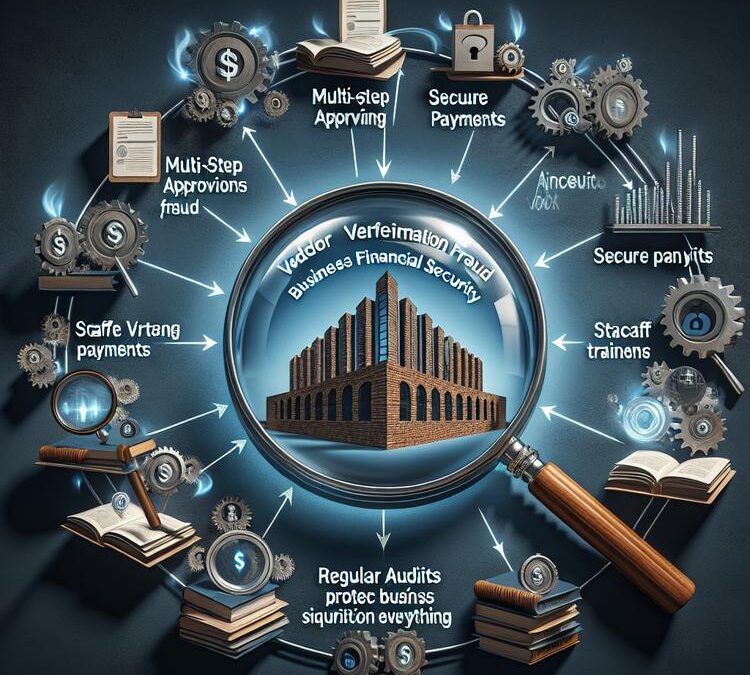

Protect your business from evolving invoice fraud threats. Learn key strategies: vendor verification, multi-step approvals, secure payments, staff training, and regular audits. Stay vigilant to safeguard financial integrity.

Article

In today’s digital landscape, invoice fraud poses a significant threat to businesses. As leaders and IT managers, it’s crucial to implement robust strategies to safeguard your organization’s financial integrity.

Understanding the various forms of invoice fraud is the first step. From fake invoices to sophisticated phishing scams, fraudsters are constantly evolving their tactics. To counter this, establish a rigorous vendor verification process and maintain an up-to-date vendor database.

Implementing a multi-step approval system is key. This ensures that no single point of failure can compromise your entire payment process. Combine this with secure payment methods like EFTs, which offer enhanced traceability compared to traditional checks.

Vigilance is paramount. Train your staff to recognize red flags such as urgency in payment requests or unexpected changes in vendor details. Leverage technology to automate invoice tracking and fraud detection, but don’t underestimate the power of human intuition.

Regular audits and reviews of your invoicing processes are essential. These not only help identify potential vulnerabilities but also ensure compliance with evolving regulatory standards.

Remember, protecting your business from invoice fraud is not a one-time effort but an ongoing process. By staying informed and proactive, you can significantly reduce risks and safeguard your organization’s financial health.

For solutions and protection Protect Your Business from Invoice Fraud, visit

https://linkedin.com/in/thecriticalupdate.

[This post is generated by Creative Robot]

Keywords: fraudprevention, Invoice fraud prevention, Business financial security, Vendor verification strategies

Recent Comments